View in web-browser

Welcome to our weekly edition of AI & Finance™!

Hello, friends, and welcome to our latest rundown of the rapid development of artificial intelligence within the financial services industry. This week, we cover more of the disruption within financial, and in particular, wealth management stocks due in part to pressures from encroaching technology. We also uncover a bit of evidence, in our AI & Finance headlines column, that artificial intelligence won't be the rising tide that lifts all boats. AI Education is a double-dip this week with a new piece on decentralized AI, operating on the exciting nexus between AI and blockchain, and, for contrast, a quick revisit to an earlier column concerning AI hyperscalers. This week also boasts a huge venture capital fundraising haul headlined by Elon Musk's xAI, and the return (with a little rejiggering) of our popular AI Intelligence Top 10 news items column. There's a lot to get to, so we'll go ahead and encourage you to scroll down to... CHECK IT ALL OUT BELOW!

Well, it happened again. That's probably the wrong way to look at the big U.S. stock market decline earlier this week, which for the second week in a row was led by financial stocks, and which has also generally been attributed to artificial intelligence-related pressure. It's probably better to say that it's still happening, and it's probably best to say that the AI-related pressure is just accelerating. Welcome to another week of AI & Finance, where in the headlines below you'll find an astonishing amount of AI in wealthtech news. But first, let's talk about the down day on Monday, which is probably... CONTINUE HERE

Artificial intelligence and the financial services industry-an industry infamous for being slow to embrace new and developing technologies-may seem like they're very different. But they're actually extremely similar in one key attribute: Despite what appears to laymen as a dizzying diversity, they're pretty centralized, with most of the power and influence being held by a relative handful of dominant organizations and companies. Chances are, if you've used AI, you know these actors-pure-play AI model providers like Anthropic, OpenAI; tech giants like Microsoft, Amazon and Google. The hyperscalers and incumbent big tech companies. They're like the Goldman Sachs, Bank of America-Merrill... CONTINUE HERE

Venture capital activity accelerated again this week, where we saw seven fundraising announcements come in above the $100 million threshold. The biggest announcement, per FinSMEs, came from San Francisco-based xAI, which raised $7 billion in a Series E as it approaches a merger with SpaceX. xAI, which is led by Elon Musk, will use its new funding to "accelerate its platform-scale expansion and facilitate its strategic integration into SpaceX following their historic merger," according to the announcement. Our second announcement is from San Jose, Calif.-based AI infrastructure firm SambaNova, which raised $350 million in a Series E to "expand SN50 production, scale SambaCloud... CONTINUE HERE

AI's influence on financial services is evolving from experimental to operational and strategic - spanning regulatory guidance, real-world use cases, investor sentiment, fraud challenges, and shifts in market leadership. This week saw sovereign funds deploying AI at scale, regulators and central banks issuing new frameworks, industry players jockeying for advantage in payments AI, and both companies and markets reacting - sometimes dramatically - to AI-linked news. These developments reflect how firms are balancing innovation with security, compliance, and competitive positioning. Norway's $2.2 trillion sovereign wealth fund deployed AI tools to scan corporate ESG data - including forced labor, corruption, and fraud - improving its ability to identify problematic... CONTINUE HERE

This time we're going to tackle a fundamental artificial intelligence topic that all of us should already know pretty well, it's just that journalists and the technology industry have applied a confusing term to the topic that they never bother to define for anyone. I guess we could say that's what we do almost every week right here in this column, but that's what we get when we're covering new technology in a pretty lazy journalistic environment. This time around, we're going to talk about AI hyperscalers, which are entities with the resources to build massive amounts of AI infrastructure, enabling themselves (or... CONTINUE HERE

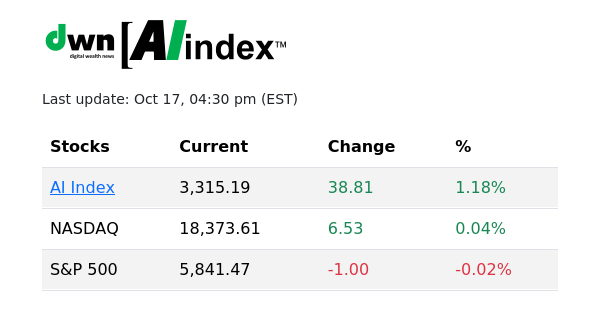

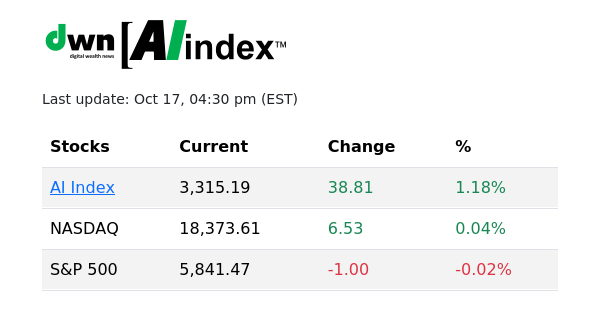

Source: thefinancials.com | Updated every 30 minutes, M-F during market hours

The DWN AI Index™ is a benchmark stock index of the artificial intelligence (AI) sector. The index is comprised of a diversified group of stocks deriving a significant percentage of their revenue from AI applications. REVIEW HISTORICALS HERE

STOCKS COMPRISING DWN AI INDEX:

Amazon (AMZN) * Arista Networks (ANET) * AI (C3.ai) * CrowdStrike Holdings (CRWD) * Duolingo (DUOL) * iRhythm Technologies (IRTC) * Microsoft Corporation (MSFT) * NVIDIA Corporation (NVDA) * Palantir Technologies (PLTR) & * Taiwan Semiconductor * Manufacturing (TSM)

Bozeman • MT • 59715 • USA

https://dwealth.news

Unsubscribe