View in web-browser

Welcome to our weekly edition of AI & Finance™!

We're back again for another round of AI & Finance on one of the scariest weeks of the year-not only is it Halloween holiday season, but another U.S. election is upon us. We can't speak for our readers, but we often find ourselves taking refuge in non-political news when a presidential election approaches and the rhetoric heats up-and what better non-political topic to tackle than artificial intelligence, where one can find enthusiasm, excitement and not a little controversy without having to endure the slings and arrows of declaring oneself for a candidate or cause. There's plenty to discover this week, but don't take my word for it... CHECK IT ALL OUT BELOW!

A recent survey of 100 wealth management executives found that every single firm questioned had already started adopting AI in parts of their operations. These executives expected their AI budget to double over the next three-to-five years. An Acrew Capital and Money20/20 survey found that 167 out of 221 top financial services companies, or 76%, have launched an AI initiative since January 2023. Nearly half of these companies are implementing generative AI in customer-facing products. According to market researcher Markets and Markets, the AI in Finance Market is expected to reach $190.33 billion by 2030 from $38.36 billion this year, at a compound annual growth rate of 30.6%. ... CONTINUE HERE

For anyone working in the financial industry in a role involving investing, the concept of compound or composite AI should be familiar: Composite AI is different artificial intelligence models applied in a coordinated manner to achieve a difficult-to-reach outcome. Just as some investment offerings are model portfolios comprised of other models-models of models-composite or compound AI is a model comprised of artificial intelligence models. Compound artificial intelligence represents a transition in AI from individual models built for specific tasks to generalized systems. The different ways that many AI components can be combined and rearranged are stepping stones to general artificial intelligence... CONTINUE HERE

While no deal exceeded the $100M threshold, this past week was an active one for venture funding in AI. This week's top reported deal, per FinSMEs, came in from the GPU cloud space, where GMI Cloud raised $85 million to support its AI-supporting computing solutions. The next biggest announcement was in the biotech space, where Pathos AI brought in a $62M Series C round. The top five also included companies in the cybersecurity and enterprise AI spaces. Smaller funding raises that did not quite make our top 5 this week included announcements from the medtech, property and casualty insurance, invest-tech and fintech sectors... CONTINUE HERE

The recent BIG SKY AI Conference brought together industry leaders and C-level executives from financial advisory, investment management, private equity, and technology firms to discuss the rapidly evolving landscape of AI in wealth management. The conference showcased cutting-edge AI technologies, including a wealth and banking application that "feels" remarkably human, chilling AI-insights into the psychology of human decision-making, and platforms that streamline marketing, risk, and compliance. The overarching theme was clear: personal connections between advisors and clients are paramount. AI allows advisors to spend more quality time with clients by automating routine tasks and providing actionable insights... CONTINUE HERE

Tariffs are a huge talking point in the upcoming U.S. presidential election. Let's listen to Al and Ivy (AI-generated by Notebook LM) discuss the pros and cons on tariffs. The conversation delves into the potential inflationary effects of tariffs, particularly on consumer goods and supply chains, and how the inflationary impact can be mitigated under certain conditions. The podcast then moves on to China's economic structure and government policies that mitigate the inflationary impact of tariffs and the use of tariffs as a diplomatic lever... CONTINUE HERE

Artificial Intelligence (AI) is at the forefront of technological advancements, with applications such as facial recognition systems and virtual personal assistants becoming increasingly commonplace. As AI continues to evolve, so does its potential for generating images, creating implications for many industries, including wealth organizations. However, despite the promising potential of AI-generated images, there are vital concerns that wealth organizations must grapple with. One of the primary concerns is data security. AI systems are typically powered by large quantities of data, some of which may be sensitive, especially in the context of a wealth organization... CONTINUE HERE

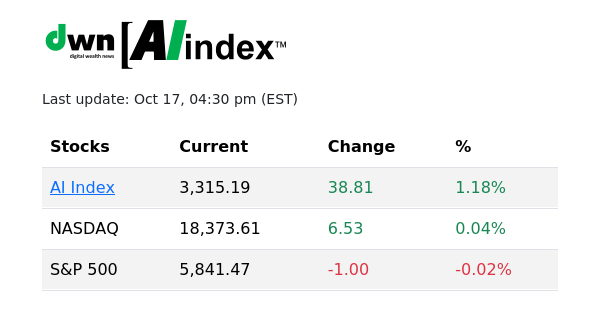

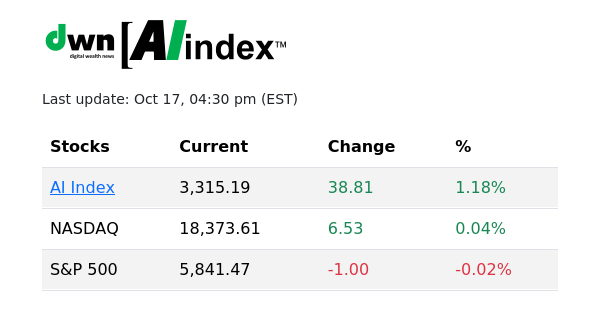

Source: thefinancials.com | Updated every 30 minutes, M-F during market hours

The DWN AI Index™ is a benchmark stock index of the artificial intelligence (AI) sector. The index is comprised of a diversified group of stocks deriving a significant percentage of their revenue from AI applications. REVIEW HISTORICALS HERE

STOCKS COMPRISING DWN AI INDEX:

Amazon (AMZN) * Arista Networks (ANET) * AI (C3.ai) * CrowdStrike Holdings (CRWD) * Duolingo (DUOL) * iRhythm Technologies (IRTC) * Microsoft Corporation (MSFT) * NVIDIA Corporation (NVDA) * Palantir Technologies (PLTR) & * Taiwan Semiconductor * Manufacturing (TSM)

Bozeman • MT • 59715 • USA

https://dwealth.news

Unsubscribe