View in web-browser

Welcome to our weekly edition of AI & Finance™!

Hello friends, as always, there's a lot to get to in the world of artificial intelligence in the financial services sector. While macroeconomic news, including a potential pending recession in the U.S., has captivated a lot of attention lately, any financial and economic slowdown seems to be a long way away from AI. Even in financial services. We have a solid report of AI headlines accompanied by an overview of recent research and thought leadership from Microsoft. Greg Woolf is definitely on the same wavelength this week in his AI Regs & Risk columnn, where he discusses some of the economics of AI adoption and deployment, and then check out a huge week for venture capital AI fundraises in our top 5. Even if Main Street seems to be slowing down, and there's fear and doubt in the air on Wall Street, AI remains full speed ahead, for now... CHECK IT ALL OUT BELOW!

This week we'd like to start by talking about Microsoft, which published its annual Work Trend Index about a week ago as of this writing in which the company polled more than 31,000 business leaders in 31 different countries, asking extensively about their company's use of AI and their thoughts about artificial intelligence technologies in the future. The headline numbers confirm much of what has already been reported-82% of the leaders in the survey believe AI is already revolutionizing the way their organizations work. The same proportion said that, within the next 12 to 18 months, they will use artificial intelligence as... CONTINUE HERE

This week in AI Education we're going to talk about the Turing Test, whether AI has passed it, what that might mean for the future and whether the Turing Test is really all that meaningful to us in the first place. That sounds like a lot to get to but it really isn't, I promise. If you're a dedicated AI & Finance reader, you'll know I mentioned the Turing Test last week in my introduction as I noted just how much of the activity on the internet is now accounted for by bots, many of which are operated by artificial intelligence. In case... CONTINUE HERE

Enterprises adopting AI are moving beyond "let's-see-if-it-works" pilots into an Efficiency phase where every deployment must prove ROI-forcing fresh conversations about pricing. Just as the cloud era swapped hefty, up-front licenses for SaaS subscriptions, today's AI era is experimenting with new ways to charge for agentic work. As AI agents start operating like virtual employees, finance, IT, and business leaders will need fresh metrics to track performance and value. Most early adopters of new technology start with sand-boxed proofs of concept (Phase 0: Experimental) where success meant "it runs without crashing." After the tech starts to show promise, enterprises move into scaling limited... CONTINUE HERE

This week our announcements are led by three deals exceeding the $100 million threshold. The top reported deal, per FinSMEs, came from Centennial, Colo.-based True Anomaly, a space security company, which raised a $260 million Series C round to fund growth and expansion, including four upcoming launches within the next 18 months. The next biggest announcement came from the identity space, where San Francisco-based Persona brought in a $200 million Series D round. The top five also included other companies in the risk, IT and accounting spaces. Smaller funding raises that did not quite make our top 5 this week included announcements from... CONTINUE HERE

Welcome to this week's edition of AI Intelligence, where we spotlight the most viral AI developments from April 25 to May 2, 2025. From major corporate investments to groundbreaking legislation, AI continues to reshape industries and society at large. Here are the top 10 stories for the past week that have captured the world's attention. Microsoft and Meta reported robust earnings, attributing significant growth to their AI initiatives. Microsoft's Azure cloud services saw a 33% year-over-year increase, with AI contributing nearly half of that growth. Meta highlighted its AI-driven advertising tools as a key revenue driver, leading to a 4.5% stock surge. OpenAI... CONTINUE HERE

In this week's podcast, our dynamic AI duo - Al & Ivy - discuss the top imports into the United States and their source nations. The content was generated thru NotebookLM from this content source: "The Sources of America's Top Imports" from - interestingly - the website for Axis Warehouse Logistics. This source examines America's top imports, highlighting the types of goods the U.S. primarily brings in and the countries that are the leading suppliers. It details key import categories such as electronics and machinery, vehicles, mineral fuels, pharmaceuticals, and metals, providing context on their importance to the American economy and daily life. The text also... CONTINUE HERE

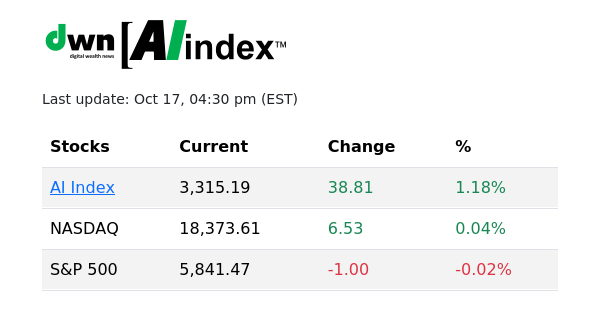

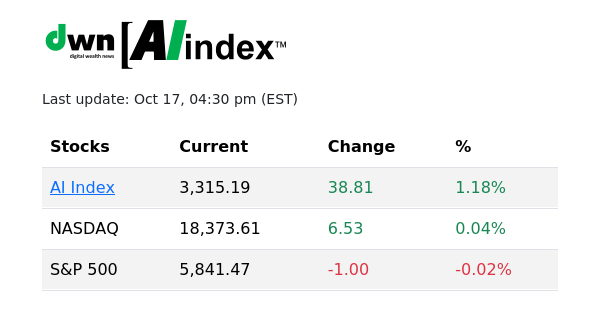

Source: thefinancials.com | Updated every 30 minutes, M-F during market hours

The DWN AI Index™ is a benchmark stock index of the artificial intelligence (AI) sector. The index is comprised of a diversified group of stocks deriving a significant percentage of their revenue from AI applications. REVIEW HISTORICALS HERE

STOCKS COMPRISING DWN AI INDEX:

Amazon (AMZN) * Arista Networks (ANET) * AI (C3.ai) * CrowdStrike Holdings (CRWD) * Duolingo (DUOL) * iRhythm Technologies (IRTC) * Microsoft Corporation (MSFT) * NVIDIA Corporation (NVDA) * Palantir Technologies (PLTR) & * Taiwan Semiconductor * Manufacturing (TSM)

Bozeman • MT • 59715 • USA

https://dwealth.news

Unsubscribe