View in web-browser

Welcome to our weekly edition of AI & Finance™!

We'd like to start out by talking about last week's AI & Finance newsletter. There wasn't one, in case you didn't notice, because we took the holiday week off. But if you're reading this, there's a very good chance we did automatically send another copy of our April 12 newsletter your way, and we apologize for the duplication. This week, we do have a lot of ground to cover, starting with a pessimistic musing about the future of trust on the internet in our AI & Finance headlines column. We also look at functional AI categories in AI Education, offering our readers a different framework for thinking about the technology. There are two weeks worth of material in some of our offerings this time around, including a bigger-than-usual venture capital top 5 column, not to mention Al & Ivy giving us a double-dose of timely podcast discussions ... CHECK IT ALL OUT BELOW!

Before jumping into the headlines, however, I'd like to assure you that this introduction is written by a human being. You see, it's getting harder and harder to discern between the work of artificial intelligence and the work of a human being. AI is becoming skilled enough to trick our species' bullshit meter-an informal Turing test of a sort. Maybe we should write something about the Turing test and whether an AI has actually passed it or not-we'll hold that thought. All this musing was brought on by a recent report from French security provider Thales, noting that automated internet traffic has surpassed... CONTINUE HERE

In the past, we've sliced up the AI universe by sophistication and capability, with three levels of artificial intelligence: Weak (or narrow) AI, Strong AI or Artificial General Intelligence (AGI), and artificial super intelligence or Super AI. As we've discussed, all AI currently in use is weak AI, that is, all artificial intelligence is sub-human intelligence, and both AGI and Super AI are as yet theoretical and unrealized. There's a different way to organize and think of artificial intelligence technology, and that is by functionality. In researching this article, we found that most publications around the web-likely citing the same sources-organize AI along... CONTINUE HERE

This week we look back two weeks to April 10, and our announcements are led by three deals exceeding the $100 million threshold. The top reported deal, per FinSMEs, came from Santa Clara, Calif.-based Auradine, an AI infrastructure company, which raised a $153 million round. The next biggest announcement came from the chatbot space, where Palo Alto, Calif.-based Manychat brought in a $100 million round. The top five also included other companies in the AI infrastructure and healthcare spaces. Smaller funding raises that did not quite make our top 5 this week included announcements from the healthcare, privacy and voice AI sectors... CONTINUE HERE

We're sitting here in the middle of Montana and a guy we know comes into our local coffee shop today with a brand new "Bright AI" backpack. We asked him what that company does and learned they are using AI in drones to monitor power lines, sewer lines, etc. Nothing pertaining to the financial sector we cover, but even so, AI IS EVERYWHERE. And if you're not tracking its growth and applications in virtually every sector, you are missing the boat (kinda like the people who dismissed crypto's potential impact early on). Don't be that person. Meanwhile, we continue covering the 10 biggest... CONTINUE HERE

In this podcast, our dynamic AI duo - Al & Ivy - discuss reciprocal tariffs. The content was generated thru NotebookLM from this content source: "Where are the highest, lowest tariffs? Trump's reciprocal tariffs explained" published on Aljazeera.com. Al Jazeera's explainer discusses Donald Trump's plan for "reciprocal tariffs," set to begin April 2nd, where the US would impose the same tariff rates on countries that those nations levy on American goods. Trump argues this is to counter unfair trade practices and reduce the US trade deficit, despite the US currently having some of the world's lowest tariffs. The article notes the US has significant trade... CONTINUE HERE

In this week's podcast, our dynamic AI duo - Al & Ivy - discuss Michael Saylor and his Plans for Strategy (previously MicroStrategy). The content was generated thru NotebookLM from this content source: "Michael Saylor's $200 Trillion Bitcoin Strategy: U.S. BTC Domination and Immortalityd" published on Coindesk.com. Michael Saylor lays out an ambitious vision for Bitcoin's future, predicting it will grow into a $200 trillion asset and serve as the foundational settlement layer for an AI-powered internet by 2045. He also advocates for the creation of a U.S. Bitcoin Strategic Reserve to help ensure American leadership in the digital asset arena. His firm, Strategy (formerly MicroStrategy), is... CONTINUE HERE

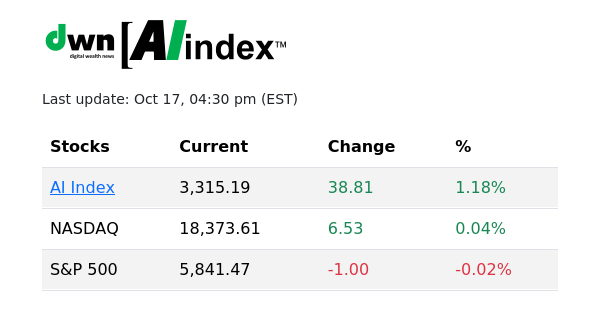

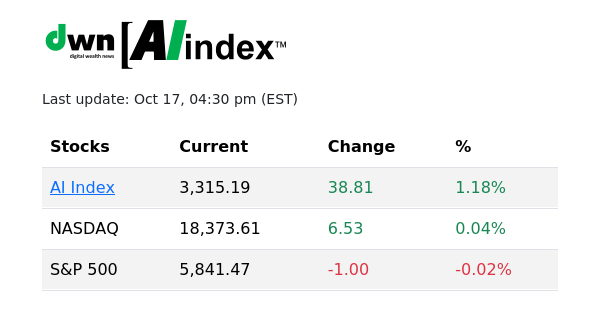

Source: thefinancials.com | Updated every 30 minutes, M-F during market hours

The DWN AI Index™ is a benchmark stock index of the artificial intelligence (AI) sector. The index is comprised of a diversified group of stocks deriving a significant percentage of their revenue from AI applications. REVIEW HISTORICALS HERE

STOCKS COMPRISING DWN AI INDEX:

Amazon (AMZN) * Arista Networks (ANET) * AI (C3.ai) * CrowdStrike Holdings (CRWD) * Duolingo (DUOL) * iRhythm Technologies (IRTC) * Microsoft Corporation (MSFT) * NVIDIA Corporation (NVDA) * Palantir Technologies (PLTR) & * Taiwan Semiconductor * Manufacturing (TSM)

Bozeman • MT • 59715 • USA

https://dwealth.news

Unsubscribe