View in web-browser

Welcome to our weekly edition of AI & Finance™!

Yes, Friends, we have a newsletter chock full of all the latest information on artificial intelligence, particularly as it applies to the financial services industry, but we should acknowledge that we're living in an extraordinary period for news about not just both technology and finance, but public policy, culture, international relations, and more. Thus, we spend a chunk of our precious time and space this week discussing the biggest financial news item so far of 2025, tariffs, and their impact on the market and artificial intelligence. We would like to call your attention to the analysis by Greg Woolf about the impact of reciprocal tariffs on trade with China as a good in-depth look at what the impacts of tariffs might be on AI in the U.S. We also take a peek at how AI is being trained in our weekly AI Education column... CHECK IT ALL OUT BELOW!

When we discussed tariffs and market volatility earlier this week in our Advisor Tech Talk wealthtech column, we mentioned that there would be little initial impact on software like wealthtech, and that holds true for the software side of artificial intelligence. AI tools are still rapidly being deployed in the financial services industry, of course, and AI development continues full-speed ahead. Previously, we've discussed how market declines and volatility like those caused by tariffs, over the long term, can impact the wealth management sector's ability to invest in technology. Financial firms eager to deploy AI don't have the luxury of waiting... CONTINUE HERE

In case you're wondering, the "how we got here" this week is my own curiosity. We've approached the topic in some of our writings about AI models and AI agents, but it's a difficult topic to research because there are often black boxes around how institutions train their AI. Think about our underpants gnomes definition. You have software that is capable of learning over time, and you have a mound of relevant information from which it can learn. How do you get your software to do something useful with that data, and then use what it has learned to understand and... CONTINUE HERE

The evolving US-China trade war is not merely a dispute over tariffs and geopolitics-it is also steering both nations toward an isolationist development strategy in artificial intelligence. As tensions escalate, each nation retreats into self-sufficient silos, a move that is especially dangerous at a critical juncture when China is already proving its innovation edge over the US with fewer high-end resources. Recent policy shifts and intensifying tariff battles have driven a wedge between the US and Chinese technology ecosystems. Both nations, eager to safeguard their technological bases, are increasingly developing AI in isolation. Yet, at a time when international collaboration has ...CONTINUE HERE

The stuff of science fiction has catapulted from the big screen to the back, middle and front offices of enterprises across the business spectrum. While the hyperbole surrounding artificial intelligence (AI) has settled into an energized buzz, technological advancements continue apace. The iterative AI processes that continually refine, redeploy and optimize capabilities are driven by money, time, energy and human ingenuity. Everyone is betting on reaping the rewards of AI functionality with a seemingly limitless potential to do more, better, cheaper and faster than ever before. The potential may indeed be extraordinary. But unlocking it comes with impediments - both in terms of ...CONTINUE HERE

This week our announcements are led by two deals exceeding the $100 million threshold. The week's top reported deal, per FinSMEs, came from Irving, Texas-based Caris Life Sciences, an AI-oriented biotech company, which raised a $168 million round. The next biggest announcement came from the AI infrastructure space, where San Francisco-based Redpanda brought in a $100 million round. The top five also included companies in the AI infrastructure and cybersecurity spaces. Smaller funding raises that did not quite make our top 5 this week included announcements from the education, finance and ESG sectors... CONTINUE HERE

Friends, META is heading to central Wisconsin to develop a new data center for its AI capabilities. Now I know Wisconsin well - I grew up in Northern Illinois - and I am SO fascinated to hear how Wisconsin is rapidly becoming a data epicenter for the artificial intelligence movement - seriously, whodda thunk. When I grew up, it was a place where there was a bar with a PBR or Schlitz sign on every corner and endless dairy and corn farms. Anyone who knows the region might also remember the truly stupendous Gobbler Club (famous for fancy turkey dinners in a round UFO-looking type building with purple... CONTINUE HERE

In this podcast, our dynamic AI duo - Al & Ivy - discuss the history, types & effects of globalization. The content was generated thru NotebookLM from this content source: "Globalization" published on TechTarget.com. This TechTarget article used for the podcast comprehensively explains globalization, defining it as the interconnected spread of ideas, knowledge, goods, and services, driven by converging economic and cultural systems and enabled by technological advancements. It outlines how globalization functions through international specialization and free trade policies, highlighting the roles of technology like the internet and transportation. The piece further examines the importance and history of globalization, including historical examples and the formation of... CONTINUE HERE

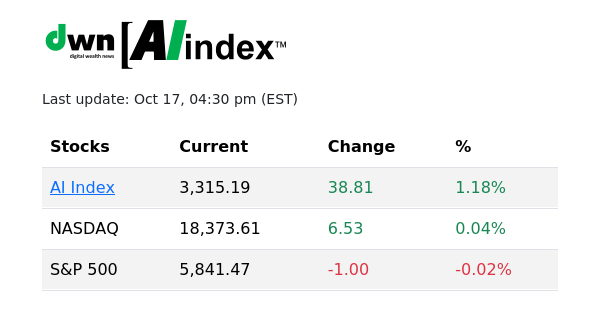

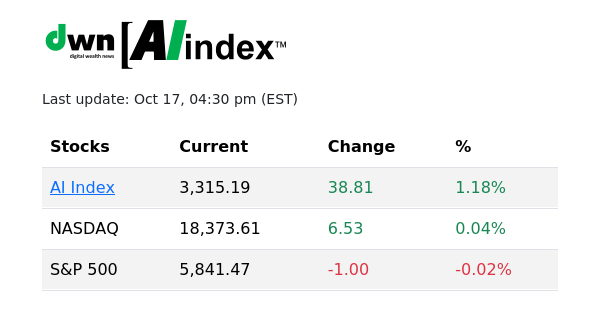

Source: thefinancials.com | Updated every 30 minutes, M-F during market hours

The DWN AI Index™ is a benchmark stock index of the artificial intelligence (AI) sector. The index is comprised of a diversified group of stocks deriving a significant percentage of their revenue from AI applications. REVIEW HISTORICALS HERE

STOCKS COMPRISING DWN AI INDEX:

Amazon (AMZN) * Arista Networks (ANET) * AI (C3.ai) * CrowdStrike Holdings (CRWD) * Duolingo (DUOL) * iRhythm Technologies (IRTC) * Microsoft Corporation (MSFT) * NVIDIA Corporation (NVDA) * Palantir Technologies (PLTR) & * Taiwan Semiconductor * Manufacturing (TSM)

Bozeman • MT • 59715 • USA

https://dwealth.news

Unsubscribe